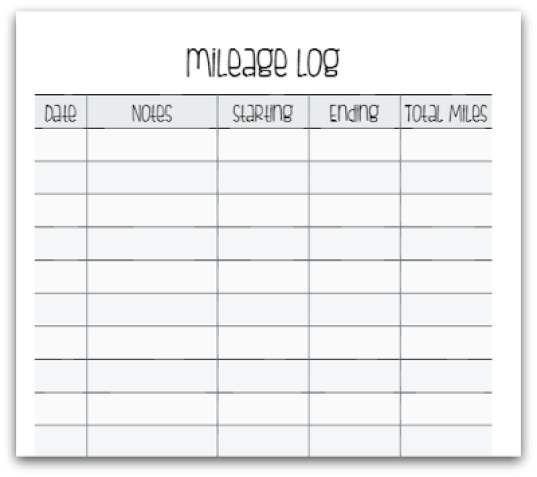

Free Printable Mileage Log For Taxes. This document can be used to file for at least a tax deduction or. Download it once, launch it once and then go about your normal day.

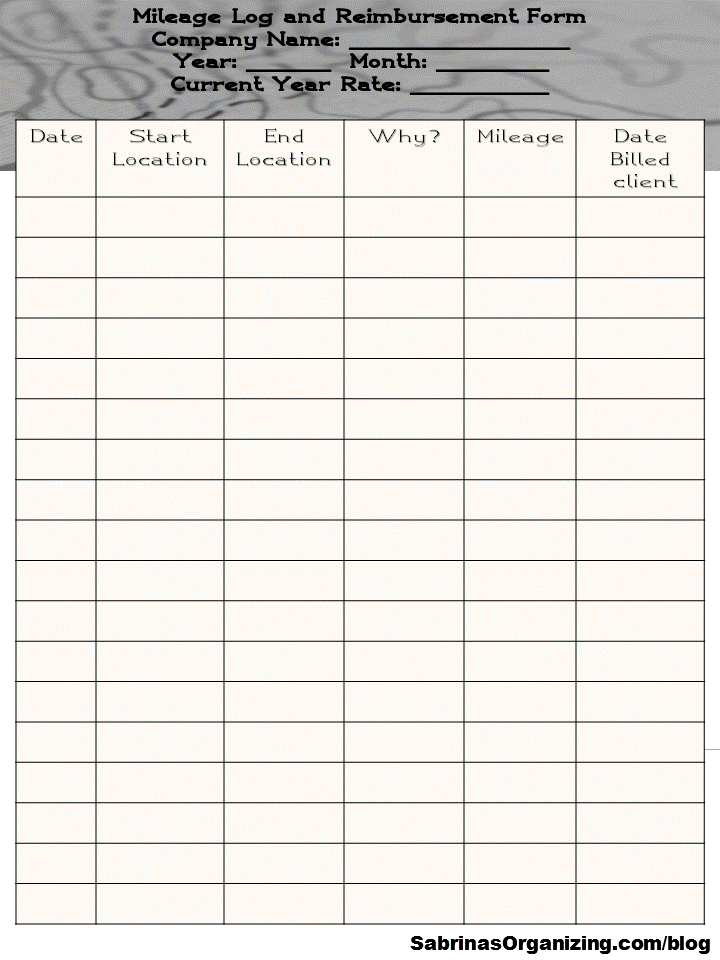

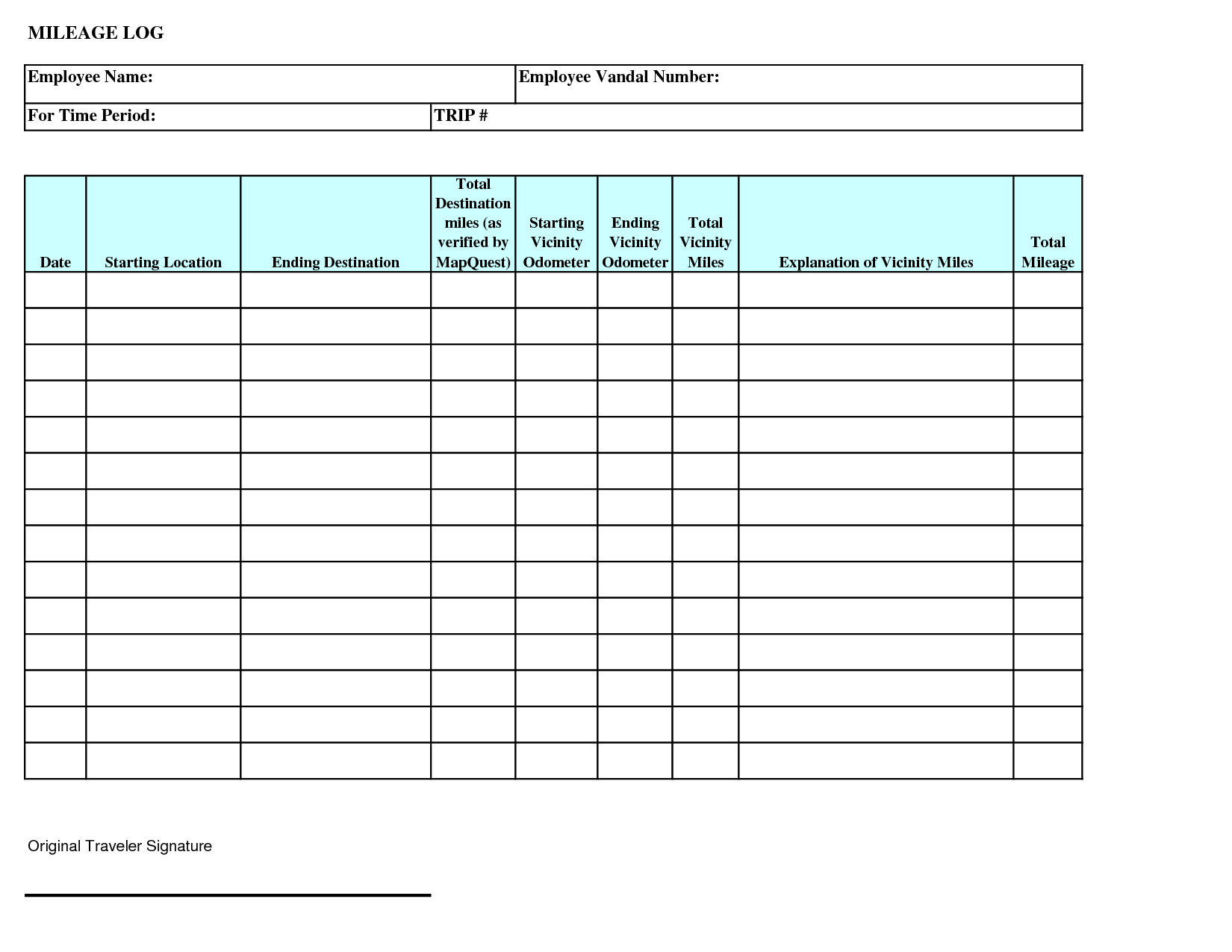

Mileage tracking is not only important for tax returns for employees but small business owners, nonprofit organizations and other non-reimbursed businesses.

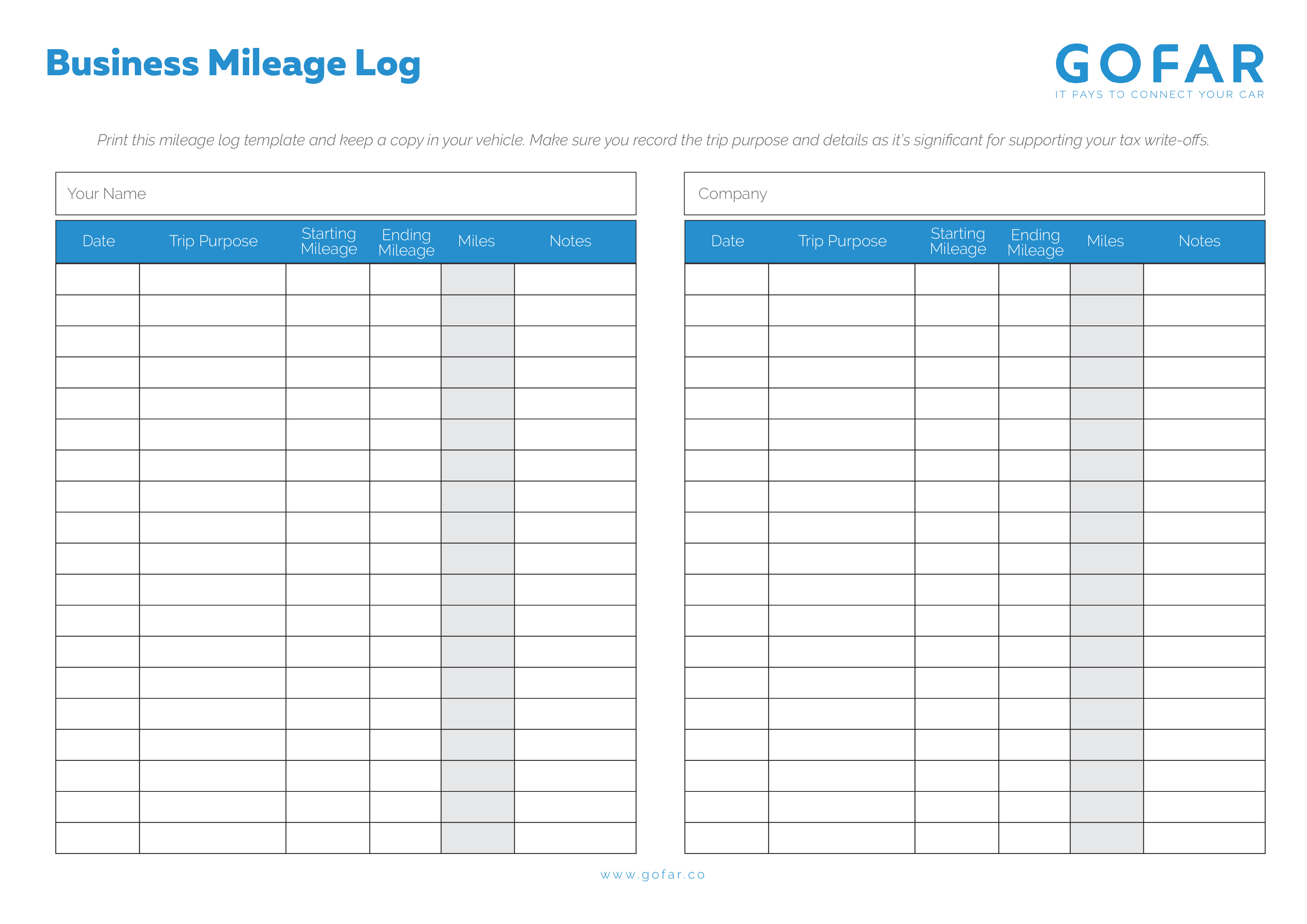

An accurate mileage log can make a big difference for anyone who spends a considerable amount of time driving their car for business purposes, such as rideshare or delivery GOFAR's Mileage Tracker Resource Centre has found a few ways to ease the burden of tracking mileage for tax deductions.

There are many purposes for keeping the vehicle In businesses, recording mileage is helpful in getting the amount of tax to be paid, reimbursement and a lot more. If you drive for business and don't receive mileage reimbursement from your employer, then you may be able to. Mileage Reimbursement - Download a free Mileage Tracking Log for Excel to keep good mileage records and calculate business mileage for tax The Business Mileage Tracker includes a Mileage Log worksheet that you can print, fold in half, and store in your vehicle.